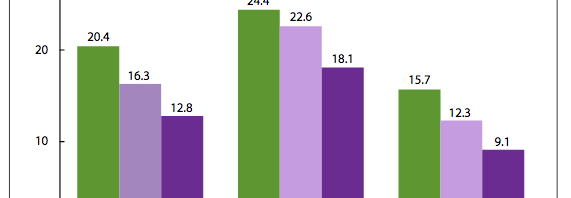

Over 7 million previously uninsured Americans gained health coverage in 2015 as a result of the Affordable Care Act (ACA, aka ObamaCare). In a previous blog post, we showed the impact the ACA had since its full expansion in 2014. Since then, the uninsured rate has dropped to single-digits with 9.1% Americans remaining uncovered by insurance, a decline of 2.4% since last year. The Affordable Care Act has been criticized by Republicans and has led to multiple attempts to repeal the health care law or states refusing to expand Medicaid to help the poorest uninsured Americans. States that have […]