Last Updated on February 3, 2020

This year we have been tracking the evolution of healthcare in the United States under the Trump administration, from the American Health Care Act (AHCA) and the Better Care Reconciliation Act (BCRA) bills failing to pass through Congress, the expiration of the Children’s Health Insurance Plan (CHIP) which covers 9 million children—many of whom have chronic health conditions—to Executive Orders undermining the Affordable Care Act (ACA; aka Obamacare) to the effect of destabalizing the insurance markets, causing confusion among consumers and higher premiums and out-of-pocket costs. More recently the U.S. Congress has been focused on tax reform, though critics have described efforts as a healthcare repeal disguised as a tax bill. This week the nonpartisan Congressional Budget Office (CBO) has scored the Senate’s Tax Cuts and Jobs Act bill that, if passed, could take effect on January 1, 2018.

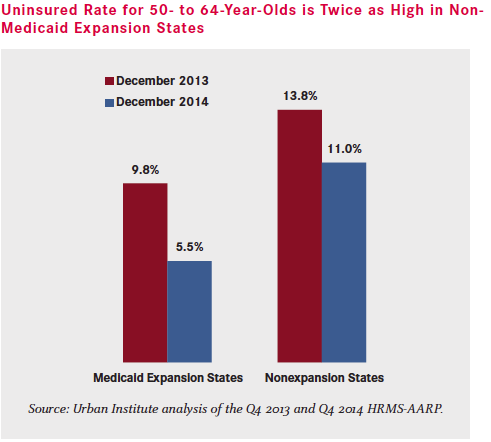

For those concerned with America’s growing debt, the CBO analysis finds the $1.4 trillion would be added to the federal deficit over the next decade. Critics decry raising taxes for lower-income families while lowering taxes for those who make over $100,000 annually. The primary concern to poor Americans comes from the tax bill’s effect on health care. The Senate’s tax bill repeals the Obamacare individual mandate that requires almost all Americans to have health insurance or else pay a penalty. As with all previous attempts to repeal the Affordable Care Act, the CBO has calculated that the change would cause insurance premiums to rise leading to millions losing their insurance in the coming years.

With no individual mandate, those opting out of buying insurance (most often lower-income people) would no longer face a tax penalty but would also lose tax credits and subsidies from the government that offset the costs for poor Americans. Poverty has a major impact on health, with people of all ages under the poverty line having generally poorer health, so lack of insurance could leave those who experience accidents or health conditions with extraordinarily high out-of-pocket costs.

Despite low public support, the Senate aims to vote on the tax bill as early as this week. NeedyMeds will try to keep our users up-to-date on further developments on health care in America. We at NeedyMeds prefer to remain apolitical—we work in a diverse office with people of varying backgrounds and views—but we believe in being informed and that those in need deserve care. It should be clear that NeedyMeds supports improved access to care as well as lower costs for medications and healthcare services for all.

NeedyMeds also encourages Americans to be active in the legislative process: If you have an opinion on the future of the Affordable Care Act or other important issues in the United States, call 202-224-3121 to reach the U.S. Capitol switchboard; from there you can be connected to your elected House Representative or Senator’s office.

NeedyMeds will continue to provide information as the need for assistance navigating the often expensive landscape of health care rises. The NeedyMeds website has databases of Patient Assistance Programs (PAPs), Diagnosis-Based Assistance (DBAs), and Free/Low-cost/Sliding-scale Clinics to help those in need. The NeedyMeds Drug Discount Card can save users up to 80% off the cash price of prescription medications for those without insurance or choose to use the card instead of insurance. In addition to the plastic card, the card is available in a printable form or the NeedyMeds Storylines smartphone app for Apple and Android devices. For more help finding information, call our toll-free helpline Monday-Friday 9am-5pm Eastern Time at 1-800-503-6897.

1 Comment