Last Updated on November 18, 2024

Prescription meds can get expensive, especially when you’re juggling rent, bills, and everyday expenses. Luckily, if you have commercial insurance, there are ways to cut those costs with manufacturer savings cards. These coupons, straight from the companies that make your medications, help bring down what you pay at the pharmacy. Here’s what you need to know about how they work and how you can use them to save.

What Are Manufacturer Savings Cards?

Think of manufacturer savings cards like digital coupons but for prescription meds. These programs are offered by pharmaceutical companies to help people lower the cost of brand-name drugs. With these coupons, you’ll pay less out of pocket when you head to the pharmacy.

The only catch is that you need commercial insurance (like insurance from your job or through the marketplace) to use these coupons. If you’re on government insurance (Medicare, Medicaid, TRICARE, etc.), you won’t qualify due to federal rules.

If you don’t have commercial insurance, check out Patient Assistance Programs (PAPs). These programs provide free or discounted meds to people who qualify, especially if you’re underinsured or don’t have coverage. To learn more about how PAPs work and how you can benefit from them, check out our blog article here.

How to Find and Use Manufacturer Savings Cards with NeedyMeds

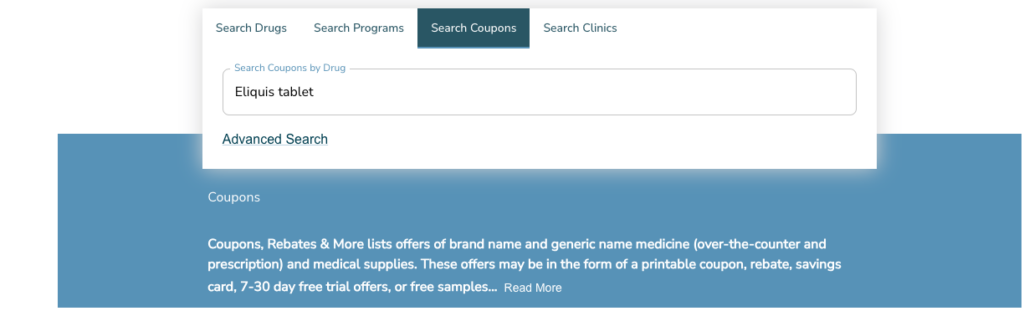

Finding and using manufacturer coupons is easy, especially with NeedyMeds. We’ve made it simple for you to locate the available savings programs for your medications, including co-pay cards and rebates. On our website, you can search for coupons when you enter the name of your drug. Here’s how to find them on our website:

NeedyMeds helps you find the best deals on your prescriptions in one place, making it easier than ever to save.

How Can you Use Manufacturer Savings Cards to Maximize Savings on Medications?

Saving on your prescriptions doesn’t have to be complicated. With manufacturer savings cards, you have several options to reduce your out-of-pocket costs. Whether you’re getting your medications at a local pharmacy or through a mail-order service, these cards can make a big difference in what you pay. To get the most of what savings cards have to offer, we recommend reading the terms and conditions for each program. Here’s some examples we see across the many copay programs we list on our website.

Uninsured Patients Paying For Their Medication in Cash

Uninsured patients can sometimes use co-pay cards to lower the cost of their medications, even when paying out of pocket. For example, this is what you’ll see on the Terms of Use on the Farxiga Savings Card:

If you pay cash for your prescription, AstraZeneca will pay up to the first $150, and you will be responsible for any remaining balance, for each monthly prescription. Other restrictions may apply.

Keep in mind that this offer is not available for patients with government insurance, like Medicare or Medicaid. However, if you’re uninsured and not on a government insurance plan, you can still use the savings card to reduce your medication costs.

Receive Reimbursement for Mail Order-Prescriptions

If you use a mail-order pharmacy, you can still take advantage of savings benefits. For example, the Farxiga Savings Card also allows you to submit a form along with the required documents to receive up to $150 in reimbursement, depending on your insurance status.

Different programs may have their own rules, so it’s always smart to check the specific terms to make sure you’re getting the best deal.

Reimbursement When Your Pharmacy Doesn’t Accept the Card

If your pharmacy doesn’t accept the savings card at the time of purchase, you can still save by paying out of pocket and then submitting a reimbursement request. For instance, if your pharmacy isn’t part of the Revatio Savings Card program, you can send your original receipt, along with the savings card information and any required documents, to the designated processing address.

It’s a handy option if your pharmacy doesn’t directly process the card. Just make sure to follow the reimbursement steps outline by your savings card program.

Important Things to Keep in Mind

- Check your insurance: Some insurance plans, like co-pay maximizer or accumulator programs, might not count savings cards toward your deductible. Confirm this with your insurance provider.

- Savings Limits: Most savings cards have monthly or yearly limits on how much you can save. Be sure to check the fine print so you know what to expect.

- Program Changes: Savings card programs can end at any time, without notice. A program will usually tell you when/if it’s ending in the terms in the conditions. If this happens, check our website for any other programs available for you.

- Reimbursement Timing: If you’re submitting a reimbursement request, it can take around 4 to 6 weeks to receive payment, so plan accordingly.